The money creation process is very helpful in understanding the role of money

in the economy. The strength of money creation is influenced by the

amount kept in the bank as a reserve for meeting the withdrawal request

of customers. This depends on money kept as a reserve so as to meet the

withdrawal of its customers. Banks usually lend customers’ money to

others with the assumption that it’s not all customers who will request

their money back at one time. This concept is called fractional reserve banking. Suppose a banker in an economy has to retain ten percent of money deposited to the bank as the reserve requirement. When

customers deposit €100 in Bank A, the deposit changes the balance sheet

of the Bank A. When the bank lends 90 percent of its deposit to another

customer, it creates two types of assets:

1. The bank’s reserve of €10.

2. The loan of €90.

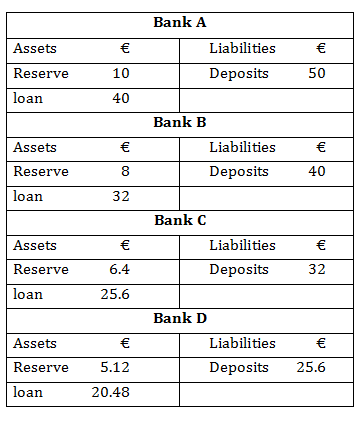

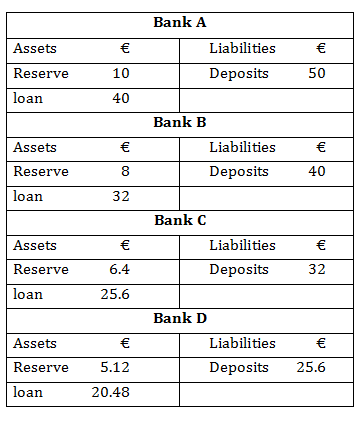

On the balance sheet, there are assets worth €50 and liabilities worth €50 resulting from the initial deposit received by Bank A. Bank A kept 20%(€10) of the deposit as reserve requirement and the remaining 80% (€40) was loaned to a customer. The customer made a business transaction with the loan and the recipient of the €40 further deposited the money into his/her Bank account (Bank B). Bank B kept 20% (€8) of the deposit as reserve requirement and then loaned the remaining 80% (€32) to a customer, etc. In each circle, the Bank keeps 20% of the deposit it receives and this will continue until there is no more money left to be deposited and loaned out. This shows how money is created by banks offering loans from money deposited by its customers. The amount of money created from one deposit is calculated by dividing the reserve requirement ratio by the deposit. From the example above, it is:

Money created = €50/0.20 = €250

It entails of all deposits in the banking system. The amount of money created by the banking system through the practice of fractional reserve banking is a function of 1 divided by the reserve requirement, and it is called the money multiplier. In some economies the central bank sets the reserve requirement, this is a potential means of affecting the growth of the economy.

Note that the higher the reserve requirement of the bank, the lesser the multiplier effect, that is the lesser money can be created.

1. The bank’s reserve of €10.

2. The loan of €90.

Calculations

Assuming a bank called Bank A received a deposit of €50 from a customer, following the principle of fractional reserve banking, money will be created in the fashion below if 20% of the deposit was decided to be the reserve requirement:

On the balance sheet, there are assets worth €50 and liabilities worth €50 resulting from the initial deposit received by Bank A. Bank A kept 20%(€10) of the deposit as reserve requirement and the remaining 80% (€40) was loaned to a customer. The customer made a business transaction with the loan and the recipient of the €40 further deposited the money into his/her Bank account (Bank B). Bank B kept 20% (€8) of the deposit as reserve requirement and then loaned the remaining 80% (€32) to a customer, etc. In each circle, the Bank keeps 20% of the deposit it receives and this will continue until there is no more money left to be deposited and loaned out. This shows how money is created by banks offering loans from money deposited by its customers. The amount of money created from one deposit is calculated by dividing the reserve requirement ratio by the deposit. From the example above, it is:

Money created = €50/0.20 = €250

It entails of all deposits in the banking system. The amount of money created by the banking system through the practice of fractional reserve banking is a function of 1 divided by the reserve requirement, and it is called the money multiplier. In some economies the central bank sets the reserve requirement, this is a potential means of affecting the growth of the economy.

Note that the higher the reserve requirement of the bank, the lesser the multiplier effect, that is the lesser money can be created.

Question

Given a 5% reserve requirement, what new deposit amount will lead to money created amounting to €100,000?

A. €5,000

B. €200,000

C. €2,000,000

Solution

The correct answer is A.

To calculate money created from addition deposit in the banking system, we use new deposit/reserve requirement formula:

Money created = New deposit/Reserve requirement

€100,000 = New deposit/0.05

€100,000 x 0.05 = €5,000

No comments:

Post a Comment